Glossary

TIP

All words use in the app is described here.

Advance

An advance is a loan granted by the insurer to the Subscriber, allowing them to access a portion of the savings accumulated in their contract to meet a temporary need for liquidity. The advance does not alter the operation or fiscal status of the contract: the invested capital continues to earn interest, and the contract’s original features and tax benefits remain intact.

Application Form

The Application Form serves as the entry document establishing the contractual relationship between the policyholder and the insurer. It contains all the necessary information to initiate the life insurance policy.

Subscription form is for financial investments.

Asset allocator

Defines the allocation and distributes the invested amounts among different asset classes or financial instruments according to the mandate given to them (such as funds, equities, bonds, etc.).

Synonyms :

- Portfolio Allocator

- Investment Allocator

Asset Manager

Assets under management (AUM)

Assets under management (AUM) is the current value of all the investments entrusted to a mutual fund, an exchange-traded fund (ETF), or an investment company.

Authorized Representative

Person or entity

An individual or legal entity who is authorized by the Subscriber to make investment switches (arbitrages) on a contract.

The Insurer may act as the Authorized Representative in the context of Discretionary Management. Otherwise, a third party may serve in this role.

Basis point (bip)

A unit of measure, equal to 1/100th of 1%, or 0.01%

Beneficiary

Person or entity

A person or entity who receives the capital at the death (or triggering event) of the insured.

Broker

A person or firm that places its customers’ insurance with an insurer

Synonym :

- intermediary

- dealer

- agent

- adviser

- Financial Investment Advisors (FIA)

Claim

Payment made by the Insurer to the Payee under the terms of the Policy.

Note: In the specific case of a partial or full surrender, this is referred to as a Buy Back.

Compartment

Each policy may comprise several compartments, each reflecting a specific investment strategy.

This aligns with the Luxembourg legal framework, where internal funds (notably dedicated internal funds – FID – or collective funds) may be structured into distinct compartments, each representing a separate sub-section of the policy.

To manage incoming and outgoing cash flows, a pay-in/out account will always be attached to the policy.

Synonym :

- Sleeves, use most for investment

Contract & Policy

Contract (legal concept)

“Contract” refers to the legal agreement between the insurer and the policyholder.

- It is the legal relationship creating rights and obligations.

- It exists once offer, acceptance, consideration, and consent are met.

- Used in legal analysis, legislation, and doctrine.

Policy (insurance instrument)

“Policy” refers to the written insurance document that evidences and formalises the contract.

- It includes the policy schedule, terms and conditions, endorsements, etc.

- It is the operative document used in practice.

- Preferred in insurance drafting and operational clauses.

The policy may be individual or group-based, subscribed by an association for the PER (French Retirement Savings Plan).

Corporate Action

A Corporate Action is an event initiated by a company that affects its shareholders or bondholders. It usually requires investors to take notice, and sometimes to make a decision.

Three main types of corporate actions

- Mandatory Corporate Actions

Shareholders do not need to take action; the event happens automatically. Examples:

Dividends (cash or stock)

Stock splits / reverse splits

Mergers or acquisitions (when shareholders automatically receive shares or cash)

- Voluntary Corporate Actions

Shareholders choose whether to participate. Examples:

Rights issues (option to buy new shares at a discount)

Tender offers (offer to sell shares back to the company)

Dividend reinvestment plans (DRIPs)

- Mandatory with Choice

Event is mandatory, but investors can choose between several options. Example:

A company offers either cash or shares as consideration in a merger.

Why corporate actions matter

They can:

change the number or value of shares you own

affect the company’s structure

influence the stock price

require decisions that impact your investment return

Custodian & Custodian Account Keeper

The term custodian is not precise and must be distinguished from the role of a central securities depository (CSD). Companies commonly referred to as custodians, such as CACEIS and SGSS, perform several roles governed by different regulatory approvals:

- Credit institutions (supervised by the ACPR) within the meaning of the CRD IV Directive. This status allows them to carry out banking activities such as:

- Accepting deposits and other repayable funds,

- Granting loans,

- Managing payment instruments.

- Investment firms (supervised by the AMF) under the MiFID II Directive, which allows them to provide certain services related to financial instruments, in particular:

- Reception and transmission of orders on behalf of third parties,

- Order execution,

- Custodian account keeping: safekeeping or administration of financial instruments on behalf of third parties (ancillary service).

- Connected to a Central Securities Depository (CSD), which requires authorization under the CSDR (Central Securities Depositories Regulation).

Caceis digital offering:

https://www.caceis.com/fr/espace-demo/olis/

The custodian account keeper is an investment firm authorized by the Autorité de Contrôle Prudentiel et de Résolution (ACPR), whose primary role is to ensure the safekeeping of financial instruments in compliance with applicable regulations.

This safekeeping consists, on the one hand, of holding financial instruments in custody on behalf of their owners and, on the other hand, of holding the corresponding assets according to the specific rules applicable to each type of financial instrument.

The custodian account keeper therefore guarantees the positions recorded in clients’ accounts, resulting from buy or sell transactions in financial instruments, or from corporate actions. It handles all types of financial instruments: equities, bonds, collective investment schemes (UCIs), derivatives, etc.

It may hold both domestic and foreign securities.

The custodian account keeper is either a direct participant of a central securities depository or a client of a participant.

The activities of the custodian account keeper are supervised by the Autorité des Marchés Financiers (AMF), which ensures compliance with professional obligations.

Entities authorized or eligible to act as custodian account keepers include banks, financial companies, and investment firms.

Functions Performed

The custodian account keeper is responsible for the administrative and accounting follow-up of transactions carried out on financial markets by its clients. It records transactions, formalizes the transfer of ownership, and informs clients about the processing of their operations.

This business mainly covers four functions:

- Settlement / delivery

- Income processing (dividends and interest) and other corporate actions

- Securities and cash accounting for client transactions

- Processing of related taxation

Settlement / Delivery

The custodian account keeper must manage securities and cash flows resulting from transactions initiated by clients (individuals or legal entities, institutional investors, etc.) and reconcile transactions with counterparties through the various market infrastructures. This function includes the following actions:

- Checking securities and cash availability,

- Initiating settlement and delivery instructions in the various information systems,

- Posting transactions to the accounts,

- Producing reporting related to transactions.

Corporate Actions

The processing of events occurring during the life of a security includes:

- Verifying the announcement of a corporate action and communicating it to clients,

- Handling client instructions, verifying them, and transmitting them to the intermediaries processing the action,

- Posting the transaction to clients’ accounts.

Examples:

- Payment of dividends and interest,

- Redemptions for the securities concerned.

Securities and Cash Accounting

Any transaction recorded by the custodian account keeper modifies the securities and cash accounting position of the relevant client.

Securities accounting follows a specific standardized chart of accounts, similar to cash accounting, notably based on double-entry bookkeeping, with the account structure defined by the AMF.

The custodian account keeper regularly reconciles the positions recorded in its books with those recorded in the books of its correspondents and of the central securities depository.

Tax Processing

Each financial transaction includes a tax component that requires:

- Analysis and application of the relevant tax treatment,

- Examples: withholding tax, exemptions, tax reclaim, etc.,

- Where applicable, preparation of tax documentation for the client,

- Reporting of income and capital gains received by the client to the relevant tax authorities and to the client.

Fees

Fees charged by the Insurer under the Contract:

- Entry fees

- Premium payment fees

- Management fees

- Switching fees

- Transaction fees

Indirect fees: asset management company fees

Financial Investment Advisors (FIAs)

These regulated professionals must choose between two statuses:

- Non-independent FIA

- Independent FIA

According to an AMF brochure intended for individual investors,

If investment advice is provided on an independent basis, your FIA:

- must offer you a sufficiently broad and diversified range of financial investments from different providers and companies with which it has no legal ties;

- must not be remunerated by the institution that manages the product it recommends to you. If it is, it must pass on to you the amount or benefit it receives;

- charges you advisory fees for the payment of its advisory services.

General account

Is an investment vehicle specific to life insurance and endowment contracts. It is capital-guaranteed by the insurer. A minimum interest rate is guaranteed, either annually (the usual case) or for a specific period (as was the case in the 2000s or in Germany). The general account is mainly invested in bonds to minimize risks (and thus the regular capital insurer’s burden) and to facilitate the forecasting and management of the rates of return provided.

Synonyms:

- Euro Fund

- General Euro Account

- Guaranteed Fund

General Assets: includes the various contract premiums as well as the insurer’s own funds.

Guaranteed Minimum Death Benefit (GMDB)

The "Guaranteed Minimum Death Benefit" (GMDB) is a feature commonly found in variable annuity contracts, ensuring that beneficiaries receive a predetermined minimum amount upon the death of the annuitant. Can be optional & included in the policy.

Insurance Product

Insured

The insured is the person to whom the events of life determine the outcome of the contract. In the case of a French capitalization contract there is no insured.

Synomin :

- Insuree : this word occasionally appears in casual usage or in non-English-speaking contexts where English is adapted, but it is not standard in insurance law or professional practice.

Insuree

Person

The insured is the person to whom the events of life determine the outcome of the contract. In the case of a French capitalization contract there is no insured.

Synomin :

- Insuree This word occasionally appears in casual usage or in non-English-speaking contexts where English is adapted, but it is not standard in insurance law or professional practice.

Insurer / Insurance Company

Entity

Bears the risk. Consequently:

- The Policyholder has a liability on the liabilities side equal to the performance of their financial instruments with respect to the Insurer on the assets side.

- The financial instruments are recorded as assets and are not held directly by the Policyholder.

Life Insurance Savings

Life insurance is a benefit received by a designated beneficiary upon the loss of Life of an insured person.

Mandatory premium, Single additional premium or Scheduled additional premium

The mandatory premium in a life insurance contract refers to the initial premium paid upon subscription of the policy.

A single additional premium refers to an extra payment made by the policyholder into an existing policy, independently of the initial or scheduled premiums.

A scheduled additional premium refers to an extra payment made at regular intervals, according to the frequency defined by the policyholder.

Mathematical Provisions

It refers to the estimated amounts owed by the insurer to its policyholders. The insurer must set aside these provisions as reserves in order to meet its obligations.

Multi-Fund Policy

Premiums are invested either in a general account or in financial market–linked products (such as bonds, equities, mutual funds, SICAVs, or real estate), known as unit-linked investments (ULs).

The insurer guarantees not the value of these units, which fluctuates, but the number of units held.

Before offering investments in unit-linked products, it is essential to determine the investor’s profile and their risk tolerance.

Partial or Total Surrender/Redemption

A surrender refers to the withdrawal of funds from a life insurance policy, either in part or in full.

In the case of a partial surrender, a portion of the accumulated savings is paid to the policyholder (even if the payer differs), while the policy remains active.

A total surrender, on the other hand, fully terminates the policy — the total value is paid out to the policyholder, and the contract is subsequently closed.

Mode de gestion (Management mode)

Gestion libre / Free management

Le Souscripteur gère lui-même ses investissements.

Gestion sous mandat / Discretionary management

les investissements sont gérés par un mandataire (souvent un gestionnaire de portefeuille).

Gestion pilotée / Managed portfolio (ou guided management) le Souscripteur choisit un profil (prudent, équilibré, dynamique, etc.) et la gestion est pilotée selon ce profil.

Arrérages (versements de rente)

Payee

Person or entity

An individual or legal entity who receives the funds following a Triggering Event. The payee may be:

- The Subscriber (in the case of a surrender)

- The Insured (in the case of retirement)

- The Beneficiary (in the case of death)

Synonym : Recipient

Payment Method

SEPA Direct Debit is used to debit bank accounts within the Single Euro Payments Area (SEPA) region. https://docs.stripe.com/api/payment_methods/object?api-version=2025-09-30.preview#payment_method_object-sepa_debit

sepa_credit_transfer, sepa_credit_transfer_instant https://docs.swan.io/topics/payments/credit-transfers/sepa/

wire_transfer

Policyholder Association

In the context of life insurance contracts and Pension Savings Plans (PER), policyholder associations play a central role in the structuring and governance of so-called group or collective contracts.

Definition and General Role

A policyholder association is a non-profit legal entity, generally established under the French 1901 law on associations, whose purpose is to subscribe to a collective insurance contract with an insurer for the benefit of its members, referred to as members or participants.

In this framework:

- the association is the policyholder of the contract with the insurer;

- the members of the association are individuals who adhere to the contract and become insured persons;

- the insurer underwrites the risk and manages the contract from a technical standpoint.

This model is widely used for retail life insurance contracts and individual PER products.

Why Use a Policyholder Association?

The use of a policyholder association serves several purposes:

Pooling and representation of members’ interests

The association collectively represents savers vis-à-vis the insurer.A secure legal and regulatory framework

The collective contract is entered into within a framework clearly defined by the French Insurance Code and the Monetary and Financial Code.Contract stability and continuity

Contractual terms are governed by specific rules and cannot be unilaterally modified by the insurer without complying with applicable procedures (information of members and, in some cases, approval by the association).Improved contractual conditions

The collective nature of the contract may allow the negotiation of more favorable fees, management options, or investment supports.

How It Works for Members

When a saver wishes to take out a life insurance contract or a PER linked to an association:

- They join the policyholder association (membership is generally automatic and free of charge).

- They adhere to the collective contract subscribed to by the association.

- They become an insured person and benefit from the guarantees of the contract.

The member maintains a direct relationship with the insurer for the day-to-day management of their contract (contributions, arbitrage, withdrawals, management options, etc.), with the association not intervening in individual management.

Main Responsibilities of the Association

A policyholder association typically carries out the following responsibilities:

- Subscription and monitoring of the collective contract with the insurer;

- Representation of members’ interests vis-à-vis the insurer;

- Information of members regarding the life of the contract (changes, updates, annual reports, etc.);

- Oversight of the proper execution of the contract, in line with the insurer’s commitments.

The association may be consulted in the event of significant changes to the contract (fees, guarantees, investment supports, management options).

Product-Specific Considerations

Life Insurance

Policyholder associations have historically been widely used for so-called “associative” life insurance contracts. They provide an additional layer of protection for policyholders.

Pension Savings Plan (PER)

Individual insurance-based PER products are, in most cases, structured as collective contracts with individual membership, subscribed to by an association, in accordance with the regulatory framework introduced by the PACTE Act.

A Governance Role, Not Financial Management

The policyholder association:

- does not manage assets,

- does not make individual investment decisions,

- does not intervene in the personal choices of members.

Its role is primarily one of governance, representation, and collective protection of policyholders’ interests.

Policyholder

Policyholder is a person or entity that owns an insurance policy, and is also referred to as a policy owner. A policyholder enters an insurance policy with an insurance company and is the individual to whom the policy is issued as stated in the certificate of insurance.

Policyholder

Person or entity

The subscriber of a life insurance contract is the person who signs the contract with the Insurance company (individual contract) or who signs a collective life insurance subscribed by a third party (example of an association) to the Insurance Company.

Accordingly, the Subscriber executes the subscription form.

Premium payer

Person or entity

A person or entity who pays the insurance premiums by any means (such as SEPA direct debit or bank transfer).

If the payer is neither the Policyholder nor the Insured, they are referred to as a “Third-Party Payer,” and in this case, they have no rights over the contract.

Premium Payment Form

Each additional contribution (payment) must be accompanied by a Premium Payment Form, specifying the payment amount, the purpose and allocation of the funds, the identity of the payer, and the source of the funds.

Depending on the circumstances, supplementary documentation may be required to comply with regulatory and anti–money laundering requirements.

If a premium payment does not correspond to a premium payment form, the payment amount is placed in a suspense account until it can be matched with the appropriate form.

Premium payment

Definition

The premium is the amount paid by the policyholder to an insurance company in consideration for the coverage of a risk assessed under the insurance policy.

Premium payments may be made by bank transfer, direct debit, or cheque (exceptionally).

The policy specifies a minimum amount of premiums to be paid. The policy is not valid if the minimum premium amount is not reached.

Two types of premiums coexist: single premiums and regular premiums.

Initial Single Premium

A premium payment made at the inception of the policy. Single premiums are non-recurring and do not create any obligation for future payments.

Additional Single Premium (or Top-Up)

A non-recurring premium payment made after the policy has been issued, in addition to the initial single premium.

Additional single premiums increase the value of the policy without modifying the premium structure.

The policy specifies a minimum amount for premium payments.

Fixed Regular Premiums

A recurring premium payment made according to a predefined frequency. Regular premiums may be paid automatically and may be modified, suspended or stopped.

The amount and frequency of premium payments are defined in the policy.

In the event of non-payment of premiums within 10 days following the due date, the insurer will send the policyholder a registered letter with acknowledgement of receipt.

If payment is not made within 40 days following the sending of this letter, the insurer may:

- either terminate the policy in the absence or insufficiency of surrender value,

- or maintain the policy with reduced benefits. However, this option is only available after two years of premium payments or if at least 15% of the total premiums have already been paid.

Synonym of Regular Premium:

- Periodic Premium

- Recurring Premium

- Scheduled Premium

Price / Net Asset Value (NAV)

The value of each share in a fund in terms of the value of its underlying holdings. NAV is calculated as the total value of a fund (stock plus cash and accruals, less fees) divided by the number of issued shares.

All exchange traded funds (ETFs), are bought and sold at their market prices, which may be at a premium or discount to NAV.

NAV as of : date of calculation

Prospective client

A potential Subscriber, from the Broker’s point of view.

This term refers to a person or legal entity in relation to a contract that may potentially be signed, meaning that the same individual or legal entity can be a Subscriber for an existing contract and also be considered a Prospective client for another.

Regulator

Life insurance is an activity regulated by law. The regulator/supervisor of the insurance sector is the Prudential Supervision and Resolution Authority (ACPR). The European body EIOPA is only an advisory body, unlike the banking sector which is regulated at the European level by the European Banking Authority (EBA).

The insurance company is subject to specific insurance accounting rules as well as Solvency II requirements. It must therefore regularly submit to the regulator a number of reports, including the Quantitative Reporting Templates QRT.

Right of withdrawal

The policyholder has a right of withdrawal allowing them to cancel the policy within 30 days of receiving the policy documents.

Single-Fund Policy

Premiums are invested exclusively in a general account.

The main feature of a general account is that the capital is guaranteed at all times, and the interest earned each year is permanently secured.

Solvency II

Solvency II is the European regulatory framework that has applied to insurance companies since 2016. It aims to strengthen the financial soundness of insurers, harmonise supervisory practices across the European Union, enhance the comparability of financial and regulatory disclosures, and provide better protection for policyholders.

The directive is structured around three complementary pillars:

Quantitative Requirements Insurers must maintain adequate capital to cover the risks to which they are exposed. Two key capital thresholds are defined:

the Solvency Capital Requirement (SCR);

the Minimum Capital Requirement (MCR).

Qualitative Requirements (ORSA) These relate to governance, risk management, and internal controls. Each insurer must demonstrate its ability to identify, measure, and manage its risks, notably through the Own Risk and Solvency Assessment (ORSA) process.

Transparency and Reporting Insurers are required to disclose regular information to supervisory authorities (ACPR, EIOPA) and to the public, particularly through:

Quantitative Reporting Templates (QRTs);

the Solvency and Financial Condition Report (SFCR).

This framework promotes a risk-based approach to supervision and contributes to the harmonisation of prudential standards across the European insurance market.

EIOPA (European Insurance and Occupational Pensions Authority) is the European body responsible for developing, coordinating, and supervising the implementation of the Solvency II framework across Member States.

Subscription

The act by which a policyholder applies for and enters into an insurance contract. It refers to the client-initiated process of requesting coverage and completing the required documentation prior to the issuance of the policy.

Synonyms :

- Application – mainly used in the US market

- Underwriting – incorrect usage: this term refers to the insurer’s internal process of assessing and accepting the risk, not to the policyholder’s act of subscribing

Suspense Account

In accounting, a suspense account is a temporary holding account used to record accounting entries pending final allocation or clarification before being posted to their definitive accounts.

Switch transaction

Fund Switch refers to the operation of transferring all or part of the amounts invested from one investment vehicle to another within the same insurance contract. This allows the policyholder to adjust the allocation of their savings according to market conditions, investment objectives, or risk profile. Fund Switch can be used to seek better returns, reduce risk, or respond to changes in personal circumstances.

Opération d’arbitrage / Fund Switch

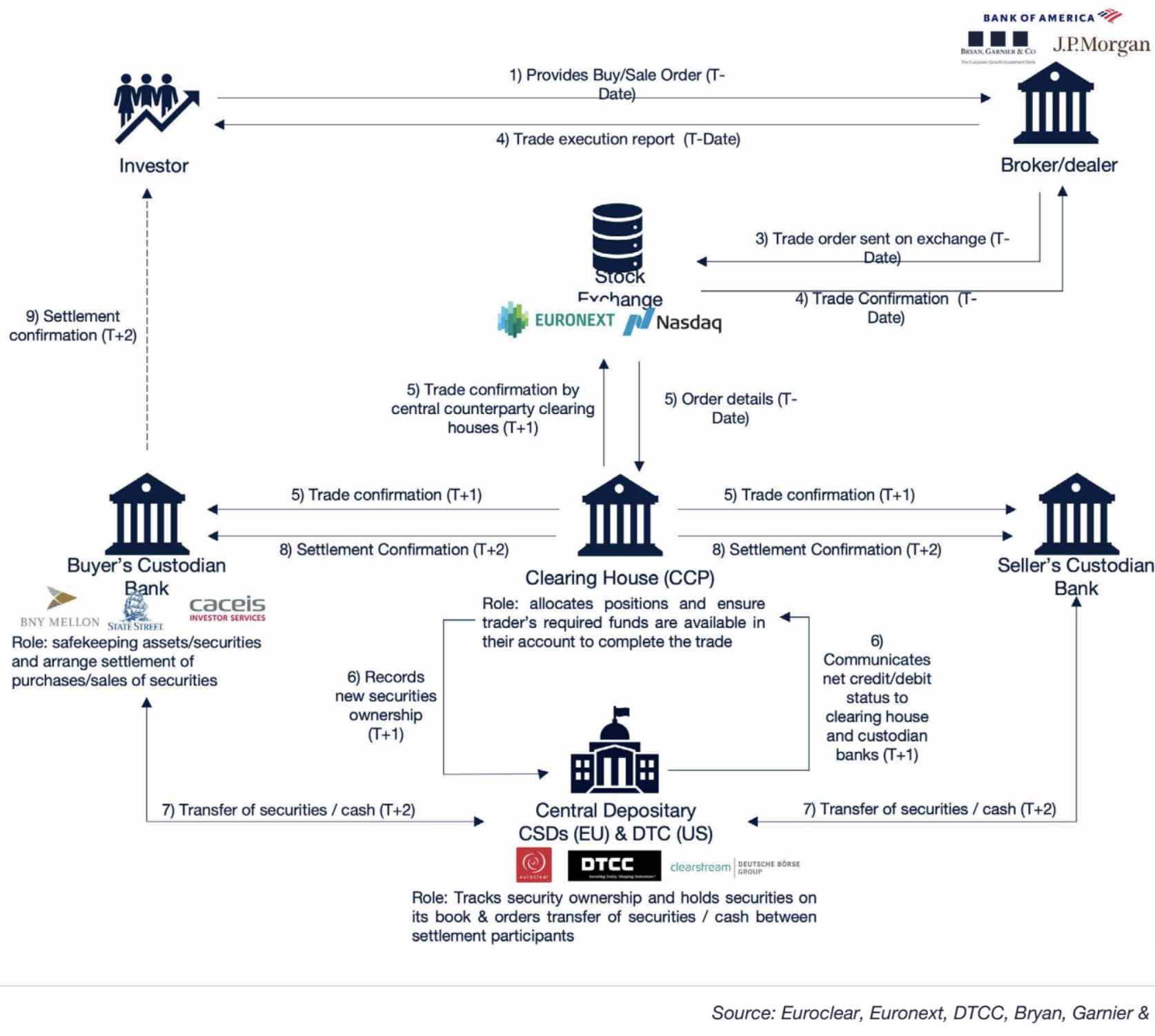

Trading date & Settlement date

Lors d’un achat ou vente de titres, nous distinguons 2 dates. Date de valeur : c’est la date d’exécution de notre ordre d’achat ou vente d’un titre. Les titres ne nous appartiennent pas officiellement mais les variations de prix sont à notre charge. Date de règlement : c’est la date à laquelle la transaction financière est effectivement finalisée, c’est-à-dire que les titres sont livrés et les fonds transférés (règlement contre titre / delivery vs paiement). Les titres nous appartiennent officiellement. La date de l’échange de l’argent contre des titres est la date de règlement. Par défaut en 2025 c’est en J+2 en Europe, J+1 aux USA en 2025, l’Europe va s’aligner sur du J+1. Sur les opérations monétaires, on parle de J+0 (règlement dans la journée du trading). Le calendrier utilisé est celui des jours ouvrés de bourse (Business day) : les week-ends ne sont pas comptés et certains jours peuvent être “fermés” alors que travaillés par la population active. ex : calendrier Euronext https://live.euronext.com/fr/resources/trading-hours-holidays

Triggering Event

Partial or full surrender: Paid to the Policyholder (as a lump sum).

Death: Paid to the designated Beneficiary (as a lump sum or as a retirement annuity if the reversion option is selected).

Retirement: Paid as a lump sum or as a life annuity.

A loan advance merely pledges the policy as collateral and has no other impact.

Underwrite

This term may refer to (a) The process of evaluating, defining and pricing insurance and reinsurance risks including where appropriate the rejection of such risks. (b) The acceptance of the obligation to pay or indemnify the insured or reassured under a contract of insurance or reinsurance.

Underwriter

Depending on the context this term may refer to: (a) the individual who is responsible for underwriting a particular insurance or reinsurance contract and who is either an employee of a managing agent, an insurance company or reinsurance company or an employee of a coverholder or any similar underwriting agent. (b) an individual member or company that insures or reinsures a risk.

Underwriters

Depending on the context this term may refer to: (a) the employees of managing agents, insurance companies and reinsurance companies and their respective underwriting agents that underwrite insurance or reinsurance risks; (b) the members or other carriers that underwrite a particular contract of insurance or reinsurance; (c) members collectively; or (d) insurers and reinsurers collectively.

Underwriting Profit

The measure of the profitability of an insurer’s underwriting activity. This refers to earned premiums (net of reinsurance) with net operating expenses and claims incurred (net of reinsurance) subtracted. The underwriting profit does not include any investment income.

Underwriting agent

A managing agent or a members’ agent.

Underwriting capacity

Depending on the context this term may refer to: (a) a member’s allocated capacity (b) syndicate allocated capacity, with or without the addition of cover from qualifying quota share reinsurance; (c) the total underwriting capacity of all syndicates combined, with or without the addition of cover from qualifying quota share reinsurance; or (d) the underwriting capacity of an insurance company or a reinsurance company. Underwriting stamp The stamp that is applied to a slip by an underwriter to signify their acceptance of a risk. It shows the number and pseudonym of the syndicate or the name of the (re)insurance company for whom the underwriter acts and has a space for their underwriting reference to be inserted. The underwriter will insert their line on a slip next to their underwriting stamp.

Unit Linked Fund

A share, stock, or financial instrument (equity, bond, mutual fund, etc.) within a contract. They are defined in the Insurance Code, Article R131-1 (French Regulation).

They are called unit-linked because they represent a number of units rather than a value in euros (as with the Euro Fund); their valuation fluctuates according to market movements.

Wealth manager

A wealth manager is a financial advisory professional responsible for assisting clients — individuals, families, and business owners — in the structuring, growth, and transfer of their wealth.

Their role is to analyse the client’s financial, tax, and estate situation in order to provide tailored solutions in investment management, insurance, estate planning, and tax optimisation, aligned with the client’s short-, medium-, and long-term objectives.

Their scope of expertise extends well beyond the management of financial portfolios, such as securities accounts or life insurance policies.